Strategies for standing out in the ultra-competitive Chinese market

Strategies for standing out in the ultra-competitive Chinese market

The Chinese market is attractive, but with aggressive local competition and consumers with ever-higher expectations, how can a foreign company really stand out and win the trust of Chinese consumers? In this article, we’ll explore some proven tips for succeeding in this dynamic and sometimes unforgiving market, even in the face of fierce competition. Whether you’re new to the market or looking to consolidate your presence, these strategies could be the key to your success in China.

Understand and adapt to the Chinese culture

Entering the Chinese market without a thorough understanding of its culture and nuances is a common and costly mistake. Here are some key elements to keep in mind:

Importance of localization:

Chinese consumers appreciate brands that speak to them in their own language and respect their customs. This is more than just translation. Localization means adapting your messaging, design, and even aspects of your product or service to resonate with local audiences. Implementing a targeted, specific marketing strategy is essential to establishing yourself in the marketplace.

Cultural nuances:

From the color of packaging to local festivals, being aware of cultural nuances can help your company avoid major faux pas. For example, red is a lucky color in China, while white is often associated with mourning.

Work with local partners: Working with local partners, distributors and/or retailers can not only ease market entry, but also enhance your brand’s credibility. They can help you navigate regulatory complexities and better understand consumer preferences.

Maximize your digital presence

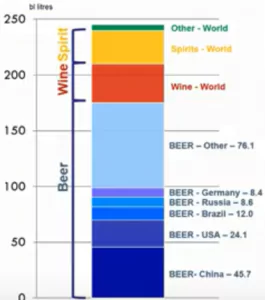

China is one of the most connected countries in the world, with a highly active population on digital platforms. Here’s how to optimize your online presence to reach and engage this audience:

The Chinese Social Media World:

In China, the main social networks are WeChat, Weibo, and Douyin. Each of these platforms has unique features and audiences that require tailored content strategies. For example, WeChat is ideal for CRM, while Douyin (the equivalent of TikTok) is essential for viral marketing. L’essor du live streaming en Chine, nouveau canal de vente en vogue – VVR International, développement stratégique, production, sourcing, distribution…

E-commerce and distribution platforms:

With platforms such as Tmall, JD.com and Pinduoduo, online commerce is a booming industry in China. Pinduoduo : l’avenir du e-commerce chinois – VVR International, développement stratégique, production, sourcing, distribution…. It’s essential to provide a smooth user experience and understand the nuances of Chinese e-commerce, such as specific “shopping days” (e.g. Singles’ Day).

Tailor content to the Chinese audience:

Create content that speaks directly to your Chinese consumers. This may mean working with local KOLs, producing customized videos, or even launching advertising campaigns specific to certain regions or cities.

Build strategic partnerships and collaborations

Collaboration is often the key to success, especially in a market as diverse and vast as China. Here’s how you can use collaborations to strengthen your position:

Work with recognized local brands:

Partnering with established Chinese brands can open doors for you and make it easier for the local public to accept your product or service. These collaborations can take the form of co-branding, cross-promotion, or joint marketing campaigns.

Attend trade shows and local events:

These events are an opportunity to meet potential partners, understand market trends, and showcase your products directly to Chinese consumers.

The Art of Succeeding in China: Adapt and Persevere

The Chinese market can be complex to navigate, but with a thorough understanding of the culture, the implementation of a multi-channel distribution strategy, and strategic alliances, your company can launch and sustain its business in China.