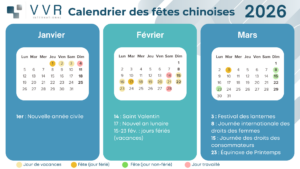

Traditional and commercial holidays in China: public holidays, vacations, and business opportunities in 2026

Traditional and commercial holidays in China: public holidays, vacations, and business opportunities in 2026

This year, Chinese New Year is celebrated on February 17 and marks the beginning of a new year under the sign of the Fire Horse. In China, traditional festivals punctuate the year, accompanied by public holidays, family celebrations, and moments of conviviality. In addition to these festivals, there are more recent celebrations focused on consumption. Whether traditional or commercial, these key dates structure the economy, influence logistics flows, are accompanied by peaks in consumption, and offer business opportunities for companies that anticipate and adapt their strategy.

A detailed understanding of these periods is therefore essential for any development project in China, whether it be to manage supplier relationships, plan production, adjust marketing campaigns, or organize the work of local teams. In this article, you will find the key dates in the calendar for the coming year!

TRADITIONAL HOLIDAYS: CULTURAL AND FAMILY PILLARS

CHINESE NEW YEAR: February 15 to 23 (PUBLIC HOLIDAYS)

Chinese New Year, known in China as the Spring Festival (春节 – Chūnjié), celebrates the first day of the lunar year. As it is based on the lunar calendar, the date varies each year. In 2026, Chinese New Year falls on Tuesday, February 17, ushering in the Year of the Horse.

This period is synonymous with family gatherings, convivial meals, and traditional rituals such as cleaning houses to ward off evil spirits and setting off fireworks. The holidays officially run from February 15 to 23, although the festivities often last for a fortnight.

Every year, millions of Chinese people travel across the country to reunite with their families. With more than 9 billion interregional trips planned by the authorities over a 40-day period, this phenomenon, known as Chunyun (春运), is the largest human migration in the world.

While this holiday is accompanied by an increase in consumption, particularly in the food, electronics, and connected appliances sectors, it also means an economic slowdown across the country. For a period of six to eight weeks, from mid-January to early March, activity slows down in businesses and government agencies as workers take time off. It is therefore advisable to anticipate this slowdown by placing orders with suppliers in advance for any deliveries that may be affected by Chinese New Year, starting in October.

LANTERN FESTIVAL: MARCH 3, 2026

The Lantern Festival (元宵节 – Yuánxiāo jié) is celebrated after Chinese New Year and marks the first full moon of the lunar new year. This year, it will take place on March 3, 2026. Colorful lanterns light up the streets, where lion dances and parades are held.

Tangyuan (glutinous rice balls) are one of the traditional specialties enjoyed on this occasion.

QINGMING FESTIVAL: APRIL 4, 2026 (PUBLIC HOLIDAY)

The Qingming Festival, or Festival of the Dead (清明节Qīngmíng jié), is dedicated to the memory of ancestors. During this festival, Chinese families visit cemeteries to make offerings and tend to graves. In 2026, Qingming falls on Saturday, April 4, and the weekend will be extended until April 6.

DRAGON BOAT FESTIVAL: JUNE 19-21, 2026 (PUBLIC HOLIDAY)

The Dragon Boat Festival will take place from June 19 to 21, 2026. This traditional celebration commemorates the poet Qu Yuan every year. This poet is a symbol of patriotism in ancient China. During these three days, dragon boat races are held. This celebration is accompanied by the tasting of sticky rice pyramids wrapped in bamboo leaves called zongzi. These three days will be public holidays.

MID-AUTUMN FESTIVAL: SEPTEMBER 25-27, 2026 (PUBLIC HOLIDAY)

The Mid-Autumn Festival (Zhōngqiū jié), also known as the Moon Festival, is celebrated on the fifteenth day of the eighth lunar month, which falls on September 25 this year, and is a public holiday. It commemorates the separation of two lovers, Houyi and Chang’e, the goddess of the moon separated from her beloved for eternity, who is only allowed to see him once a year, on the fifteenth day of the eighth lunar month.

Considered the second most important holiday after Chinese New Year, it is marked by family gatherings to admire the full moon while enjoying moon cakes.

It is common to exchange gifts during the Mid-Autumn Festival, whether with family, friends, or colleagues. Some companies give gifts to their employees on this occasion, including moon cakes.

NATIONAL DAY: OCTOBER 1 TO 7, 2026 (GOLDEN WEEK)

National Day (国庆节 – Guóqìng jié), celebrated on October 1, marks the founding of the People’s Republic of China in 1949. It gives rise to a week of holidays, called Golden Week. This is a key period for tourism, both within and outside the country.

COMMERCIAL HOLIDAYS: BETWEEN INNOVATION AND CONSUMPTION

CHINESE VALENTINE’S DAY: AUGUST 10, 2026

Chinese Valentine’s Day, or Qixi (七夕节), falls on August 10, 2026. Inspired by a romantic legend about two lovers separated by the Milky Way, this holiday is increasingly embraced by younger urban generations, who celebrate love with gifts and romantic dinners.

It represents a commercial opportunity, particularly for beauty, luxury, jewelry, and connected appliance brands, provided they opt for special marketing for the occasion. Limited editions for the Qixi festival are hugely successful. Online sales and live streaming are the most promising sales channels during this holiday.

SINGLES’ DAY: NOVEMBER 11, 2026

Known as Double 11 (双十一 – Shuāngshíyī or Shuang Eleven), or Singles’ Day (光棍节 – Guānggùn jié), November 11 has established itself in recent years as the flagship shopping day in China.

Originally conceived as a day of massive promotions on Taobao, the main platform of e-commerce giant Alibaba, Double 11 has since been adopted by many Chinese retailers to become a day of mass consumption throughout China. Every year, Shuang Eleven is marked by record sales on online shopping platforms, attracting millions of shoppers looking for bargains.

DOUBLE TWELVE: DECEMBER 12, 2026

Riding on the success of November 11, Double Twelve (双十二) is a commercial event. One month after Singles’ Day, this day allows retailers to offer new promotions to sell off their stock.

HOLIDAY ORGANIZATION IN 2026: BETWEEN WORK AND REST

In 2026, public holidays in China will follow a specific pattern. In order to maximize rest periods, the authorities often adjust the weekends preceding or following public holidays. For example, for Chinese New Year or Golden Week, working days may be moved to allow for longer holiday periods. Here is a summary of public holidays in 2026:

- Lunar New Year: February 15 to 23, with make-up days on Saturday, February 14 and Sunday, February 28

- Qingming: Saturday, April 4 to Monday, April 6

- Labor Day: Friday, May 1 to Tuesday, May 5, with a make-up day on Saturday, May 9

- Dragon Boat Festival: Friday, June 19 to Sunday, June 21

- Mid-Autumn Festival: Friday, September 25 to Sunday, September 27, 2026

- National Day: Thursday, October 1 to Wednesday, October 7, with make-up days on Sunday, September 20 and Saturday, October 10

Mastering the Chinese calendar: a strategic lever for your development in China

There are many traditional and commercial holidays in China. For foreign companies, being familiar with these holidays, public holidays, and the specific consumer practices associated with them not only helps avoid logistical or organizational surprises, but also seize the opportunities they offer in terms of communication, commercial strategy, and customer relations.

Do you have a development project in the Chinese market? Contact our experts. We would be delighted to assist you with your projects in the Chinese market. contact@vvrinternational.com

Download our 2026 calendar: