EOR in China: Meaning, Salary Standards, and How It Simplifies Recruitment

1. Introduction

Expanding into China is an exciting opportunity, but it can also be complex. For foreign companies without a legal entity in the country, hiring talent, managing payroll, and ensuring tax compliance present real challenges. That’s where EOR in China comes in. This model, also known as wage/salary portage, allows companies to recruit quickly and legally without setting up a local subsidiary. It combines flexibility for the employer with full protection for the employee. In this guide, we’ll explain the meaning of EOR in China, how it works, and why it has become one of the most efficient recruitment solutions for international companies in 2026.

2. What Is EOR?

EOR (Employer of Record) is a legal employment solution that allows foreign companies to hire staff in China without setting up a local entity. In this model, a licensed third-party provider, EOR company as VVR International, becomes the employee’s official legal employer in the country of operation. The EOR signs a compliant local employment contract with the employee and manages administrative obligations such as onboarding, contract implementation, and local labor compliance. Meanwhile, the foreign company retains full control over the employees’ day-to-day responsibilities and performance.

3. How EOR Works in China

The EOR in China model follows a simple, three-party structure:

- The client company abroad (the actual employer directing the work).

- The EOR company (the legal employer handling payroll and compliance).

- The employee (working in China for the client under a local labor contract. All administrative, legal, and payroll management is handled by the portage provider.

It allows companies to deploy staff in China within weeks, without establishing a local subsidiary or WFOE. It also guarantees that the employee receives regular salary payments, social contributions, and tax declarations under Chinese law. Take VRR RH’s example, here’s how the process works in practice:

- Needs assessment. The foreign company identifies a candidate in China or requests recruitment support. VVR RH experts verify the job scope, salary range, and location-specific compliance requirements.

- Employment contract setup. The employee signs a local labor contract with VVR RH (the EOR company), while VVR signs a service agreement with the client company abroad. This dual framework clearly defines each party’s responsibilities.

- Payroll and social insurance management. VVR handles all salary payments, tax deductions, and social insurance contributions, including the five mandatory insurances and the housing fund. The client receives a monthly invoice covering gross salary, contributions, and management fees.

- Daily management and performance. The employee works directly for the foreign company, following its operational goals and reporting structure. VVR remains the legal employer, ensuring compliance and employee welfare at every stage.

- Continuous support. Throughout the collaboration, VVR assists with visa processes, onboarding, HR counseling, and local regulations. It ensures a smooth and sustainable employment experience for both the employer and the employee.

In short, EOR lets you deploy talent in China within weeks – fully compliant, transparent, and scalable.

4. Key Advantages for Employers Using EOR in China

For foreign companies entering or expanding in China, EOR is not just a temporary fix. It’s a strategic HR solution that brings measurable business advantages.

- Rapid deployment. Setting up a Wholly Foreign-Owned Enterprise (WFOE) can take 3–6 months and involve multiple registrations. With EOR, hiring in China can start in as little as 2–4 weeks, enabling your team to start operations immediately.

- No legal entity needed. EOR removes the need for complex corporate structures. You can hire staff, test markets, or launch projects without creating a company or representative office. It is especially beneficial for SMEs or startups exploring China for the first time.

- Legal compliance. China’s labor law is strict and highly localized. VVR RH ensures compliance with local wage standards, social insurance, and tax obligations. By acting as the legal employer, the portage firm assumes responsibility for HR compliance, reducing legal exposure for your company.

- Flexibility. EOR allows employers to scale up or down quickly. If your market test proves successful, VVR can help you transition to a full entity or direct employment structure. This adaptability aligns perfectly with global companies seeking agility in uncertain economic environments.

- Cost efficiency. EOR in China offers predictable costs through transparent invoicing. You avoid hidden expenses such as company registration fees, accounting, or local audits. Additionally, you only pay for active contracts, ideal for short-term projects or flexible expansions.

In essence, EOR benefits both sides: employers enjoy flexibility and compliance, while employees gain security and recognition.

5. Wage Setting and Salary Management in China

Understanding wage setting in China is essential to define fair and compliant compensation packages.

Average Wage and Salary Data in China (2025 Update)

According to the National Bureau of Statistics of China (NBS):

- The average annual salary in urban areas in 2024 reached CNY 124,100 (≈ USD 17,200).

- The average monthly wage in China is around CNY 10,300 (≈ USD 1,420).

- The median salary in China is approximately CNY 8,200 (≈ USD 1,130) per month.

- The average wage in China per hour is about CNY 59 (≈ USD 8.15).

In fact, salaries vary significantly by city and industry. The China minimum wage (2025) ranges from CNY 1,680 to 2,690 per month, in USD, is 230–370, depending on the region. These differences highlight why a reliable EOR company is critical, ensuring competitive, compliant, and locally benchmarked salaries.

Average monthly salary by top-tier cities in China. (Source: TradingEconomics)

How Wages Are Set in China

China’s wage structure is influenced by:

- Local regulations: Provinces and cities define their own minimum wage.

- Industry benchmarks: Tech and manufacturing sectors often pay above average.

- Experience and education: Multilingual professionals or engineers earn 30–50% more than the national average.

Thus, EOR services help foreign employers navigate these differences by offering real-time benchmarking and transparent salary packages that meet both employee expectations and compliance rules.

Tax and Social Contribution in China

Payroll and taxation in China are heavily regulated, and compliance is non-negotiable. About salary tax in China, the country uses a progressive tax system on individual income.

- Tax-free allowance: CNY 60,000 per year (≈ USD 8,300).

- Tax rates range from 3% to 45%, depending on monthly income.

- Additional deductions cover housing, education, and parental care.

Moreover, both employers and employees must contribute to five mandatory insurances plus the housing fund. Rates vary by city, but these contributions add roughly 35–40% to the total employment cost. EOR in China ensures these obligations are met on time, with clear payslips and tax reports, eliminating risk for foreign clients.

Both employers and employees must contribute to five mandatory insurances plus the housing fund.

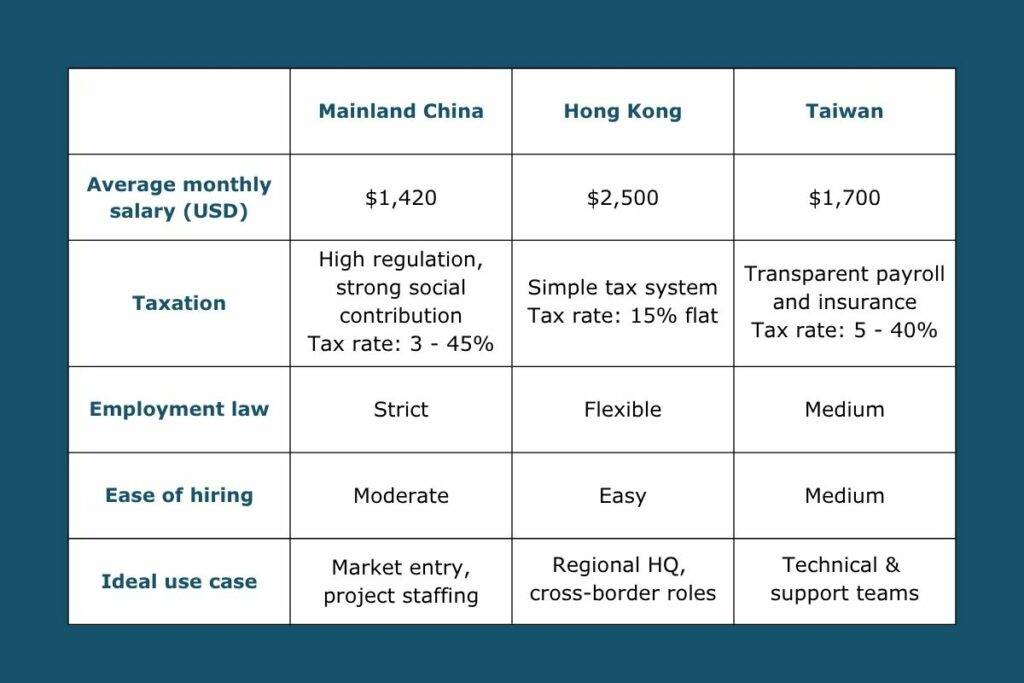

6. EOR Across China Mainland, Hong Kong, and Taiwan

Employment laws, taxation, and HR systems differ sharply between mainland China, Hong Kong, and Taiwan. Understanding these differences is crucial before selecting where and how to deploy staff.

- Mainland China has strict labor regulations and mandatory contributions, but it offers access to the world’s largest industrial and consumer market. Therefore, EOR is ideal for foreign companies seeking full legal compliance without creating an entity. It also simplifies management of social insurance, tax reporting, and regional wage variations, from Shanghai’s high salaries to emerging markets like Chengdu or Qingdao.

- EOR in Hong Kong provides maximum flexibility. Employment laws are straightforward; personal income tax is capped at 15%, and no mandatory social insurance applies beyond the Mandatory Provident Fund (MPF). Hong Kong is often chosen as a strategic base for regional coordination, especially for sales, marketing, or finance functions covering all of Asia.

- EOR in Taiwan combines transparency and affordability. Payroll and insurance are regulated under clear national laws, and local professionals often bring bilingual or technical expertise. The average monthly salary in Taiwan (2025) stands around TWD 55,000 (≈ USD 1,700), making it a cost-effective hub for support and R&D operations.

With VVR RH, companies can manage EOR seamlessly across all three regions through one trusted partner, ensuring unified payroll, compliance, and HR oversight.

With VVR RH, companies can manage EOR seamlessly across all three regions through one trusted partner.

7. Why EOR Is the Fastest Way to Recruit in China

Businesses operate in a fast-moving environment where speed and compliance define today’s competitive advantages and decide success. Through EOR, companies can hire staff in China within two to four weeks, instead of waiting months to register a legal entity. Here are 5 reasons why you should choose EOR in China for your recruitment:

- Fast onboarding. With VVR’s established HR infrastructure, onboarding can be completed in 15-30 business days. All documentation, contracts, and payroll systems are already in place. Therefore, it enables new hires to start work almost immediately.

- Full legal and tax compliance. China’s labor and tax environment can be complex. EOR ensures full compliance with local laws, from employment contracts to income tax declarations and mandatory insurances. VVR RH acts as the legal employer, taking care of documentation, audits, and social contributions, giving you complete peace of mind. Foreign employers do not need to worry about missing registrations or penalties.

- Seamless administration. We – VVR RH experts, manage the full HR cycle under one system of EOR:

- Employment contract drafting.

- Social contribution setup.

- Payroll calculation and tax filing.

- Expense reimbursements and reporting.

- The client receives one consolidated monthly invoice, making international HR management as easy as running a local team.

- Built-in mobility and scalability. When businesses expand from one city to another, EOR in China allows them to do so without delay. Employees can be reassigned, contracts adapted, or new hires added across cities. As a result, they are all within one compliant framework, giving companies the freedom to scale teams up or down easily. Thus, this flexibility is particularly useful for companies managing multi-site operations or testing regional demand.

- Cost control. EOR services offer transparent pricing and eliminate unnecessary administrative costs. You receive a single monthly invoice covering salary, social contributions, and management fees. No hidden expenses, no local accounting burdens. Therefore, the model helps companies manage their budgets accurately while avoiding the long-term financial commitments of setting up a subsidiary.

8. When to Choose EOR in China, Hong Kong, and Taiwan

EOR is ideal if your company:

- Wants to test the Chinese and/or other markets before setting up a subsidiary.

- Needs to hire employees or consultants rapidly.

- Aims to manage risk while maintaining full compliance.

- Seeks local expertise for payroll, tax, and HR management.

It’s a solution that bridges global ambition with local compliance, a smart alternative to entity creation or outsourcing. VVR International is a global consulting firm that helps companies expand across Asia through HR, market entry, and compliance services. With offices in Shanghai, Guangzhou, Shijiazhuang, Pékin, and Paris, VVR supports clients in EOR solutions, HR outsourcing, and recruitment across China, Hong Kong, Taiwan, and beyond. Our local HR specialists ensure your team operates smoothly, legally, and cost-effectively, whether you’re hiring an expert or building an entire branch.

Read more related articles:

9. Final Thoughts

Entering the Chinese market can be both exciting and challenging. Complex regulations, regional wage variations, and compliance requirements often slow down international expansion. EOR in China eliminates these barriers. It allows companies to hire talent, launch operations, and test markets without delay or legal risk. Whether you are a growing SME or a large enterprise, the EOR model gives you everything you need to succeed: speed, compliance, flexibility, and cost control. With the right local partner, you can focus on your business goals while your HR, payroll, and legal obligations are handled seamlessly.

Contact VVR RH today to discuss your project or learn more about our EOR solutions across China and Greater Asia.

FAQ

-

What are the main HR challenges in China that outsourcing helps foreign companies solve?

The main HR challenges in China include compliance with labor contract law, managing payroll across different cities, handling social insurance and housing fund contributions, and navigating work permit requirements for foreign employees.

HR outsourcing for foreign companies in China addresses these issues by providing local expertise, payroll outsourcing services, contract management under mutual agreement rules, and support for work permits. This allows companies to operate smoothly while minimizing legal and operational risks.

-

How do HR outsourcing services in China support strategic HR management and long-term growth?

HR outsourcing services in China support strategic HR management, aligning with modern HR practices in China, including digital HR solutions, employee retention strategies, and ESG-focused HR policies. By outsourcing HR functions, companies gain access to market insights, salary benchmarks, and compliance monitoring, enabling them to build sustainable teams in China while adapting to workforce trends and long-term business objectives.

Related Posts