Employees Benefits in China: Salary, Compensation, Insurance | A Full Guide 2026

1. Introduction

For foreign companies, understanding salaries and employee benefits in China is essential. The Chinese labor market is large, diverse, and regulated by strict labor laws. Knowing the details of wages, taxes, social insurance, and workplace expectations helps employers avoid risks and attract talent. In 2025, China continues to balance rising wages with a competitive workforce. According to the National Bureau of Statistics (NBS), the average annual salary in urban China reached 124,100 Yuan (≈USD 17,200) in 2024. Moreover, this marks a 6.2% increase year-on-year. At the same time, new labor regulations and social insurance obligations require careful planning. This guide explains a clear overview of employee benefits in China, including the salary structure, mandatory benefits, working conditions, and HR practices in China. It also explores challenges and strategies for foreign employers, including HR outsourcing and using an Employer of Record (EOR).

2. Salary Landscape in China: Salary Structure

International firms face higher competition for skilled workers. To succeed, companies must understand wages in China, salary structures, and benefit expectations. According to the National Bureau of Statistics of China, the average annual wage was 124,110 Yuan (~USD 17,200) in the urban non-private sector, and 69,476 Yuan (~USD 9,600) in the urban private sector. Based on a 40-hour workweek, the estimated average hourly wage is ~60 Yuan (~USD 8.5), or about 124,800 Yuan annually.

Salaries are highest in Tier 1 cities (Beijing, Shanghai, Shenzhen, Guangzhou) where average yearly pay exceeds 200,000 Yuan (~USD 28,000). However, the cost of living in these cities is also significantly higher. In Tier 2 and Tier 3 cities (Chengdu, Suzhou, Wuhan, etc.), salaries average closer to 80,000 – 100,000 Yuan per year (~USD 11,000 to 14,000). In addition, these cities now offer growing talent pools for employers. Additionally, inland provinces have much lower wages but rising competitiveness in manufacturing. Wages vary widely by region and industry. Sectors such as finance, IT, and biotechnology command premium salaries, while agriculture and textiles remain lower.

Practical insight: Employers entering the Chinese market should benchmark salaries by region and sector. Compensation that works in Shenzhen may not attract talent in Chengdu or vice versa.

Mnimum Wage and Labor Types

China does not have a national minimum wage. Instead, each of the 31 provinces and municipalities sets its own rates, adjusted every 1–2 years. For instance, in 2025:

- Shanghai has the highest minimum wage at 2,690 Yuan per month.

- Smaller provinces set minimums closer to 1,500–1,800 Yuan per month. Anhui has the lowest minimum wage at 1,350/month Yuan.

Labor contracts in China are divided into three categories:

- Fixed-term contracts. It is common for new hires, must last at least one year.

- Open-term contracts. After two fixed-term renewals, workers can request one.

- Project-based contracts for temporary or seasonal work. It tied to a specific project timeline.

This system is designed to balance flexibility with worker protection, in line with the Chinese Labor Law. Employers must sign a written labor contract within 30 days of hiring. Otherwise, they face fines.

Salary Tax in China

China applies a progressive personal income tax (PIT) system for salary tax (State Taxation Administration of China). Standard deduction is 60,000 Yuan per year. From 3% to 45% depending on income, as below:

- Income up to 36,000 Yuan → taxed at 3%.

- 36,001 – 144,000 Yuan → 10%.

- 144,001 – 300,000 Yuan → 20%.

- 300,001 – 420,000 Yuan → 25%.

- 420,001 – 660,000 Yuan → 30%.

- 660,001 – 960,000 Yuan → 35%.

- Above 960,000 Yuan → 45%.

Employers must withhold taxes monthly and report them to the authorities. Foreign employees are taxed on their China-sourced income. Since 2024, some expatriate allowances (like housing and children’s education) remain tax-exempt. As a result, relocation has become more attractive for foreign workers. In addition, many foreign SMEs use payroll outsourcing in China to handle tax, benefits, and compliance. As a result, this ensures accurate filings and reduces the risk of errors.

3. Social Insurance and Mandatory Benefits (The 5+1 Model)

Employee benefits in China include additional compensation such as overtime pay, medical insurance, vacation, profit sharing, and retirement benefits.

China’s “five insurances and one housing fund” are mandatory:

- Pension insurance ensures financial security for employees in retirement.

- Medical insurance covers a portion of medical expenses for employees.

- Unemployment insurance provides financial assistance in case of job loss.

- Work injury insurance covers medical expenses and compensation for work-related injuries.

- Maternity insurance supports employees during pregnancy and childbirth.

- Housing provident fund (+1) aims at helping employees save for housing-related expenses.

Contribution rates vary by city. For example, in Beijing:

- Employers pay around 27–30% of an employee’s gross salary.

- Employees contribute around 10–12% of gross salary.

In Shanghai, employers contribute ~27%, employees ~11%. These costs must be budgeted into total employment packages. Otherwise, companies face penalties, back payments, and even legal liability. Furthermore, Chinese citizens and foreigners are subject to different social security contribution regulations. Shanghai temporarily exempts foreign workers from paying China’s foreigner social insurance. Foreigners are required to pay full Chinese social insurance in other Chinese cities.

According to PwC China HR Updated 2025, foreign employees must also contribute unless exempt under a bilateral agreement. However, workers from Germany or South Korea benefit from such exemptions.

Supplemental Employee Benefits in China: 101 Overview

Employee benefits in China include additional compensation such as overtime pay, medical insurance, vacation, profit sharing, and retirement benefits. These benefits are essential for showing concern for employee well-being. It also attract and retain top talent while differentiating a company from its competitors. Thus, it is imperative for employers to understand the relevant regulations in China to ensure fair wages and appropriate benefits when hiring or establishing a subsidiary. Beyond statutory benefits, companies must offer additional perks to attract top talent and retain staff. Common supplemental benefits include:

- Performance-based bonuses.

- Additional paid leave.

- 13th month or “double pay” bonus, especially in MNCs.

- Commercial health insurance, covering gaps in public healthcare.

- Meal, housing, and transport allowances, especially in manufacturing hubs.

- Training budgets to support upskilling.

- Flexible benefits such as mental health support, gym memberships, or flexible working hours.

Overall, these employee benefits improve retention and help foreign firms compete with local champions in China.

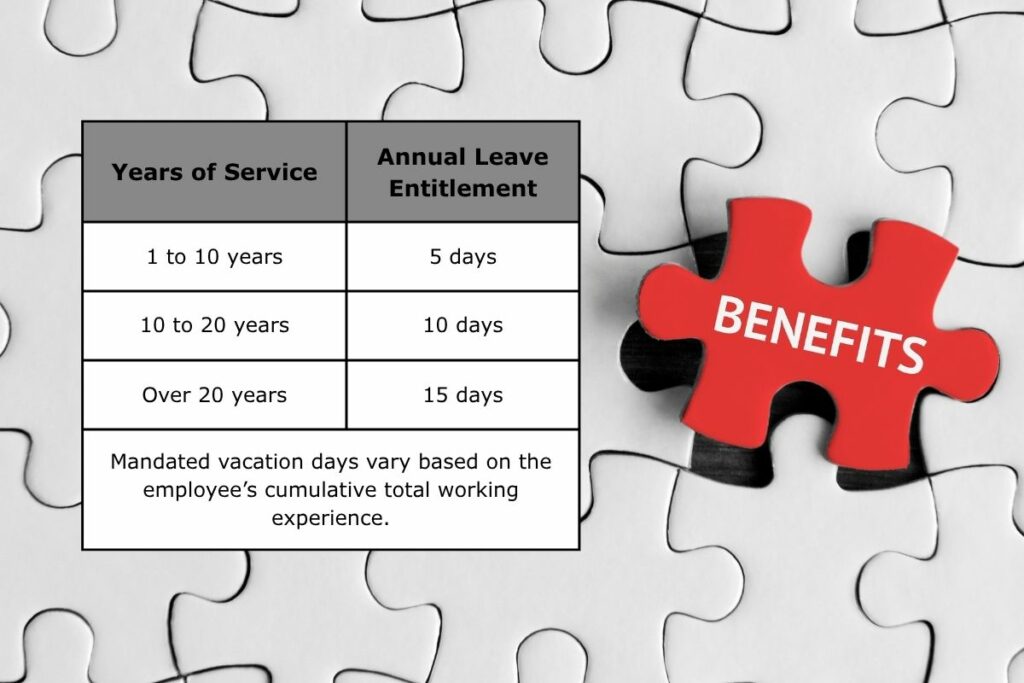

Paid annual leave in China is mandated, from 5 to 15 days depending on seniority.

4. Working Conditions in China

Strict labor laws and cultural norms shape working conditions in China.

- Standard working week: 40 hours, typically Monday – Friday.

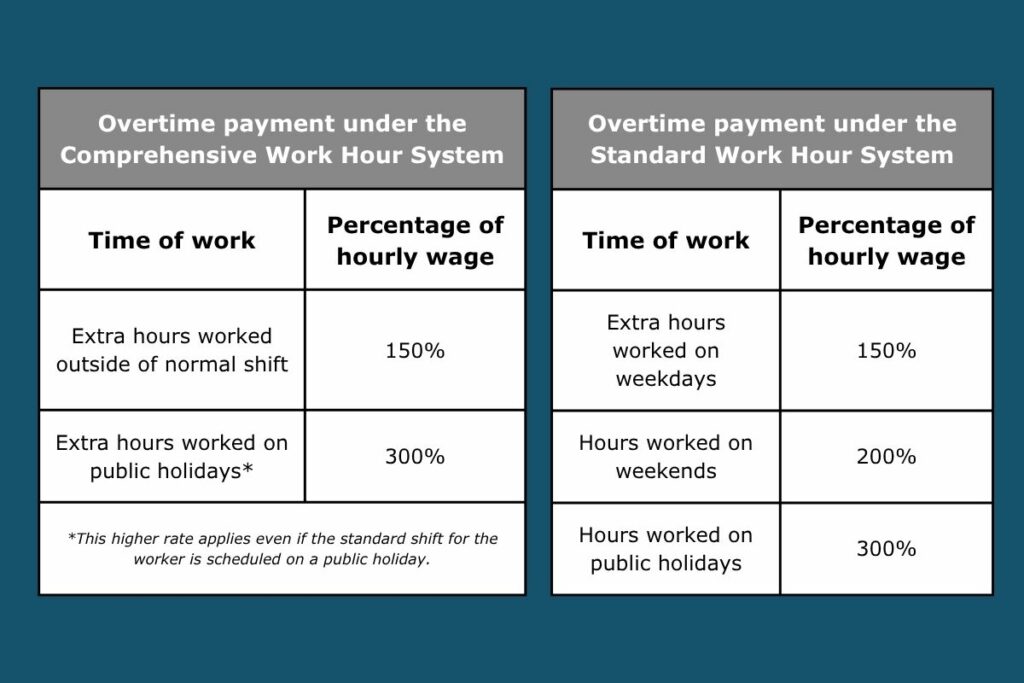

- Overtime is regulated, with premiums ranging from 150% to 300% of base pay, depending on whether it falls on weekends/holidays.

- Paid annual leave is mandated: 5 – 15 days depending on seniority. Specifically, 5 days of paid vacation per year (1 – 10 years), 10 days (10 – 20 years), 15 days (20+ years).

- Maternity leave: 98 days minimum, with extensions in some provinces.

It is common for foreign employers to offer more vacation time to mid-level or senior managers. These offers frequently include up to four weeks of annual vacation time.

Overtime is regulated, with premiums at 150% – 300% of base pay.

5. Key Differences Between China and Global Benefits

Worldwide companies typically offer a range of benefits to their employees, including health insurance, paid time off, and retirement plans, with additional options such as training, wellness programs, and childcare support. These benefits align with the company’s size, location, and industry standards, playing a crucial role in employee satisfaction and retention.

In Western countries, such as the US and UK, employee benefits vary based on employer policy and local legislation. Health insurance is common but not universally mandated. Retirement savings plans, such as 401(k) in the US, are prevalent, and benefits often include paid vacation, parental leave, and flexible working hours. Some regions provide more favorable leave policies and health services.

In certain Asian countries, including Japan, Singapore, and South Korea, employee benefits are robust as well, covering health insurance, paid leave, and work injury protection. Loyalty among employees is often rewarded with enhanced benefits, with China’s employee benefits reflecting substantial governmental oversight. Each Asian nation customizes its benefits according to cultural and economic factors.

For China, the government plays a strong role in controlling employee benefits, leading to a more structured but less flexible system compared to other countries where private companies set benefit plans. Chinese law mandates consistent social and housing benefits across companies, with global firms providing additional perks to attract talent. While vacation days in China are fewer than in many Western nations, maternity leave is generally longer, alongside specific leave allowances for personal events like marriage and funerals, contrasting with the often more customizable leave policies found elsewhere.

⇒ Do you want to explore more about recruitment practices across regions? Read our guide on Recruiting in China and Europe: Key Differences and Tips for Adapting to understand how hiring processes differ and how to adapt your HR strategy.

6. Challenges for MNCs in China’s Labor Market

China offers a wide range of opportunities for global employers. Rising wages, a strong middle class, and a skilled workforce make it an attractive market. However, challenges remain:

- Rising wages increase costs.

- Regional disparities in salary and benefits.

- Complex payroll systems.

- Compliance with Chinese labor law requires expertise.

Foreign companies in China need to navigate complex labor benefit laws to avoid fines and legal issues. Therefore, collaboration with local experts becomes essential. The cost of providing mandatory benefits such as social insurance and housing fund payments can be significant, especially for smaller firms.

Additionally, employers must understand the expectations of Chinese employees. Many prioritize social stability and housing support. This is critical for retaining staff and ensuring satisfaction. Thus, for SMEs, using HR outsourcing in China or an Employer of Record (EOR) can reduce risks, simplify hiring, payroll, and compliance for expat staff.

Read more related articles

7. Conclusion

China’s labor market continues to evolve. NBS reported urban surveyed unemployment at 5.1% in April 2025. Employment opportunities are strongest in technology, renewable energy, logistics, and advanced manufacturing (World Bank China Economic Update, April 2025). In conclusion, understanding employee benefits in China, the average salary in China, and payroll compliance is essential. In fact, these are critical success factors for any business entering the market.

For foreign firms without a legal entity, Employer of Record (EOR) services are a popular solution because setting up a local entity in China can take months. We – VVR RH can help you with our professional services:

- The EOR hires employees on behalf of the foreign company.

- Handles contracts, payroll, taxes, and benefits.

- Allows market entry without registering a subsidiary.

If you want to test the Chinese market without high upfront costs, Ean OR service is a suitable solution.

⇒ Contact us today to discover how our HR outsourcing services in China 2026 can help your business hire employees, manage payroll, and stay compliant.

FAQ

-

What are the main HR challenges in China that outsourcing helps foreign companies solve?

The main HR challenges in China include compliance with labor contract law, managing payroll across different cities, handling social insurance and housing fund contributions, and navigating work permit requirements for foreign employees.

HR outsourcing for foreign companies in China addresses these issues by providing local expertise, payroll outsourcing services, contract management under mutual agreement rules, and support for work permits. This allows companies to operate smoothly while minimizing legal and operational risks.

-

How do HR outsourcing services in China support strategic HR management and long-term growth?

HR outsourcing services in China support strategic HR management, aligning with modern HR practices in China, including digital HR solutions, employee retention strategies, and ESG-focused HR policies. By outsourcing HR functions, companies gain access to market insights, salary benchmarks, and compliance monitoring, enabling them to build sustainable teams in China while adapting to workforce trends and long-term business objectives.

Related Posts