EOR/PEO Services in China: Detailed Explanation and Legal Insights for Foreign Companies

PEO Services in China: Detailed Explanation and Legal Insights for Foreign Companies

1. Introduction

China continues to attract foreign companies, but hiring employees directly is never simple. The country’s strict labor laws, complex payroll system, and regional social insurance rules make compliance a serious challenge. For businesses that want to expand quickly, PEO services in China provide a practical solution. In this article, we – VVR RH, explain what EOR/PEO services are, how they work, and what legal updates in 2025 – 2026 mean for foreign businesses. We also compare EOR/PEO with alternatives like WFOEs, helping you decide which approach best supports your China expansion.

2. What Are EOR/PEO in China?

Before diving into regulations, it is important to define what PEO means in China. A Professional Employer Organization (PEO) is a local HR service provider that becomes the legal employer of record for your staff. PEO allows companies to hire employees in China without creating a local entity. While the PEO handles payroll, contracts, and benefits, the foreign company still manages the employees’ day-to-day work.

This model reduces time, costs, and legal risks while ensuring compliance with Chinese regulations. In fact, PEO services are now one of the most popular choices for SMEs and multinational firms testing the market. This arrangement is also referred to as EOR in China, since in practice, the PEO functions as the employer of record. In China, the difference between the two is more technical than practical.

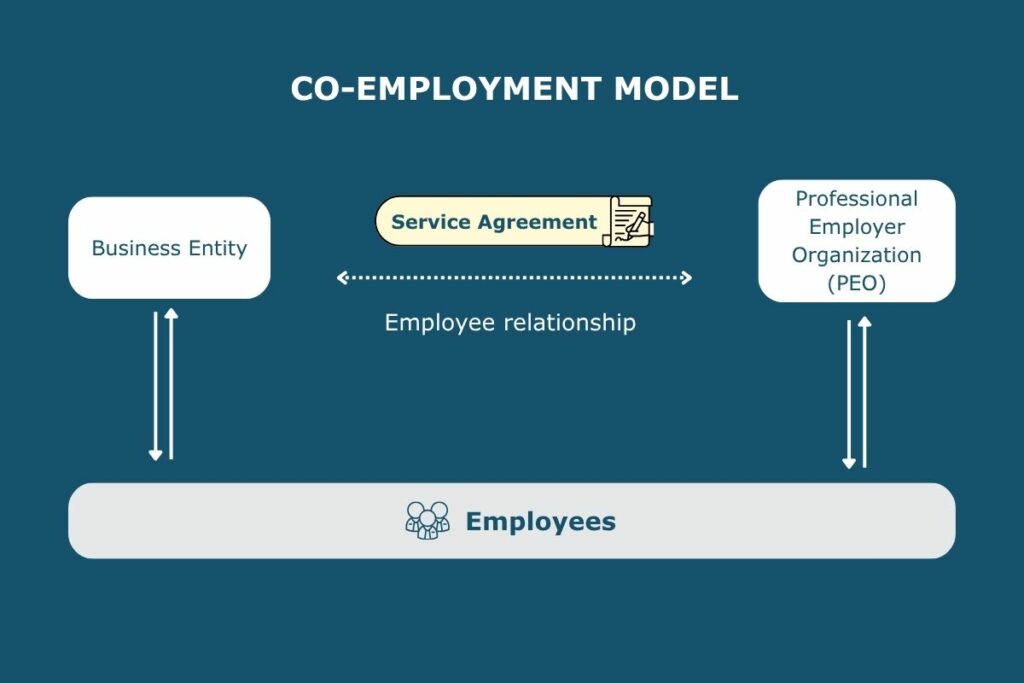

Co-employment involves a business and a professional employer organization (PEO) jointly sharing specific employment responsibilities through a contractual relationship.

PEO and EOR in China: Definitions

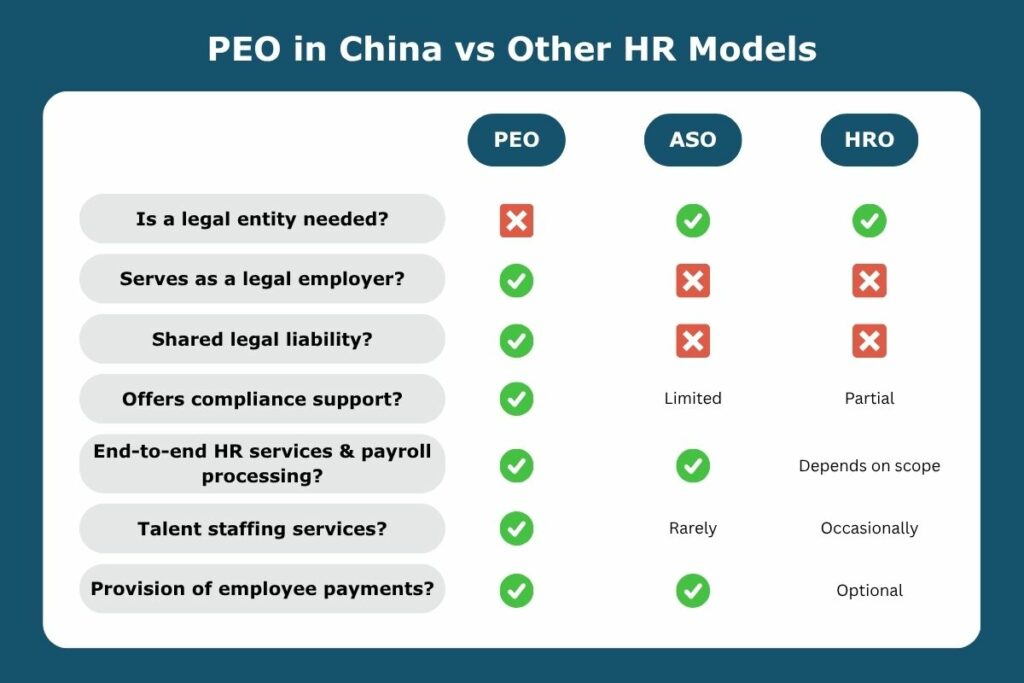

Although the terms are used interchangeably, understanding the PEO and EOR helps decision-makers.

- PEO (co-employment). Both the PEO and the client share employer roles. The PEO handles HR and payroll, while the client directs the employee’s work.

- EOR (full legal employer). It refers to when the PEO is the sole legal employer. The client company manages the employee’s duties but does not appear as the employer on contracts.

In China, most providers market PEO/EOR services together, so the difference is largely branding. The choice depends on whether the company already has a legal entity in China. If yes, PEO services complement the entity. If not, EOR solutions in China provide a full legal employer framework.

Benefits of Using This Service in China

For many foreign companies, the benefits go beyond compliance.

- Market entry speed: Start operations quickly.

- Legal security: Reduce exposure to fines or lawsuits.

- Employee satisfaction: Timely salary, insurance, and benefits build trust.

- Strategic flexibility: Scale staff up or down as business needs evolve.

- Access to HR expertise: PEOs understand local practices, from contracts to dispute resolution.

Ultimately, PEO/EOR services in China free up foreign firms to focus on sales, sourcing, and growth — while experts handle HR and compliance.

Risks and Challenges

Of course, no model is without drawbacks. Companies should understand the risks before committing.

- Legal gray areas. In some regions, PEO services may overlap with restricted “labor dispatch.” Choosing a licensed provider reduces this risk.

- Higher long-term costs. Service fees may exceed the cost of setting up a WFOE if hiring dozens of staff.

- Employee perception. Some Chinese employees may prefer direct contracts with foreign entities.

- Dependence on provider. The client relies on the PEO’s systems and expertise.

- Mitigation strategy. Conduct due diligence and choose a provider with proven compliance, transparent pricing, and local licensing.

3. Why Foreign Companies Choose PEO/EOR in China

Expanding in China is complex, but PEO services simplify the process. For foreign companies, the benefits are immediate and significant.

- Speed. A PEO can onboard employees in days, while setting up a Wholly Foreign-Owned Enterprise (WFOE) may take 3–6 months. So, it is critical for companies testing the market or starting pilot projects when applying PEO service in China.

- Compliance. China has strict rules for labor contracts, payroll, and mandatory benefits. PEOs ensure full compliance with the Chinese Labor Contract Law and local bureau requirements.

- Flexibility. Companies can start with one or two employees before scaling up. If the business shifts, they can also exit without facing heavy closure costs.

- Risk reduction. PEOs reduce the risk of fines, penalties, or employee lawsuits related to misclassification.

- Cost efficiency. SMEs can avoid the high registered capital and administrative costs linked to entity setup.

In short, PEO services in China provide a low-risk bridge for foreign companies that want to operate in the country without committing large investments upfront.

Furthermore, the demand for PEO services in China is set to rise, driven by several key trends. Many companies are adopting a China+1 strategy, combining their China presence with expansion into ASEAN markets such as Vietnam and Thailand, and PEO solutions make this dual approach easier to manage.

At the same time, the rise of digital PEO platforms, powered by AI and automation, is streamlining payroll, enhancing compliance monitoring, and reducing costly errors. Moreover, high-growth sectors such as green energy, semiconductors, and AI are attracting increasing foreign investment, creating strong demand for compliant hiring models.

Together, these factors indicate that PEO services will remain a critical tool for businesses entering China, offering agility and compliance in an unpredictable global market.

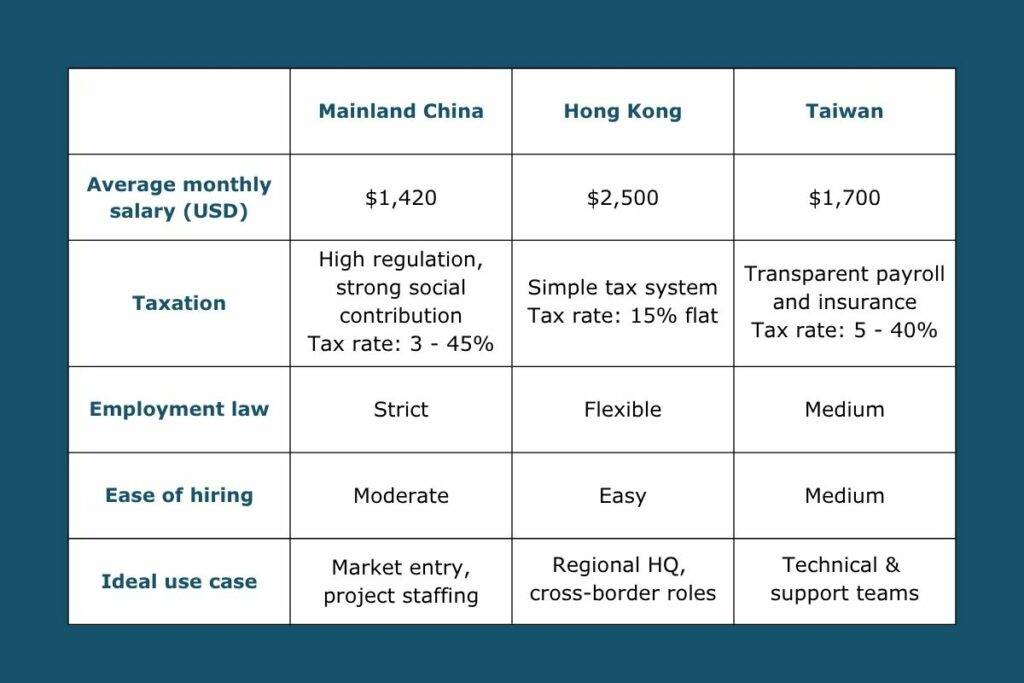

Comparison between PEO/EOR and WFOE (Wholly Foreign-Owned Enterprise) in China.

4. Legal Environment for PEO Services in China (2026 Update)

China’s labor market is heavily regulated, and foreign companies must follow the same laws as local employers. PEOs step in as the legal buffer to ensure compliance.

- Employment contracts. Every employee in China must have a written labor contract in Mandarin. Contracts must specify job roles, working hours, wages, benefits, and termination clauses. PEOs prepare these contracts according to Chinese law, protecting foreign companies from non-compliance fines.

- Social insurance and housing fund (5+1 model). Employers must contribute to the “five insurances and one housing fund” which are pension, medical, unemployment, work injury, maternity, and housing fund. Contribution rates vary by city. For instance, in Shanghai, employers pay around 27% of salary, while employees contribute ~11%. PEOs manage these payments accurately, avoiding penalties and ensuring employees receive their benefits.

- Probation and termination rules. Probation periods are capped based on contract length, ranging from one to six months. Termination without proper cause requires severance pay. Mishandling termination is one of the most common risks for foreign firms, and PEOs reduce this risk by following the correct procedures.

- Expat employment rules. Hiring foreigners in China requires work permits, Z visas, and residence permits. PEOs can handle these processes, ensuring documents meet requirements and reducing visa rejection risks.

- Legal updates. Crackdowns in Beijing and Shanghai on the misuse of labor dispatch agencies. Stricter enforcement of social insurance for foreign workers, unless exempted by bilateral agreements. More digitalized labor administration systems, requiring timely online filings.

To sum up, these updates make it more difficult for foreign companies to hire directly without expertise, further reinforcing the value of EOR/PEO services in China.

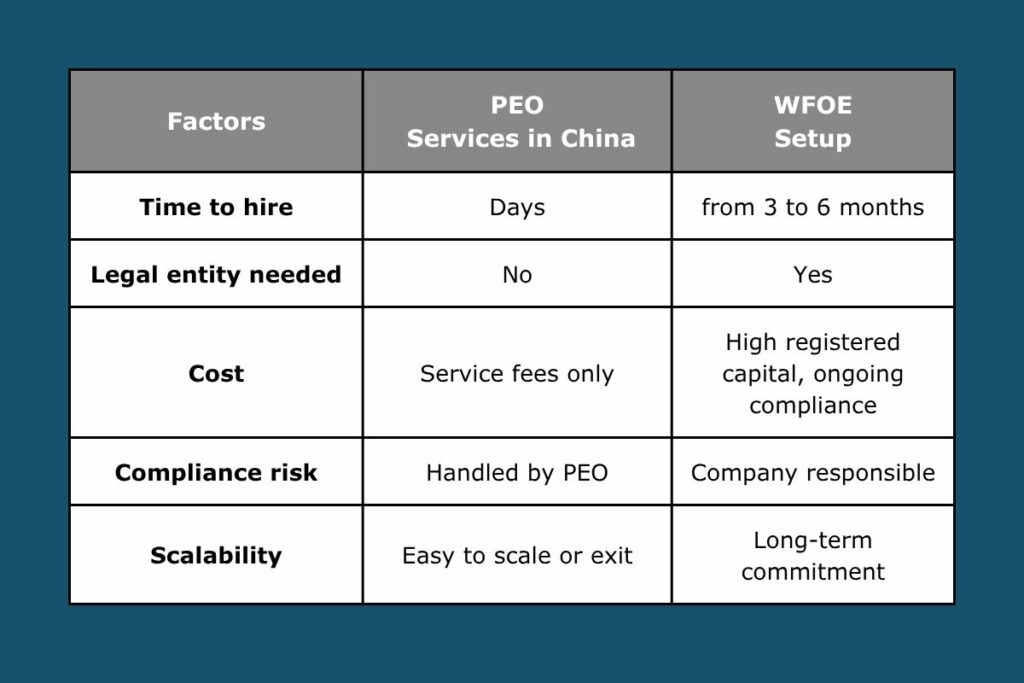

5. EOR/PEO vs. Setting Up a WFOE in China

Foreign firms often compare PEO with setting up a Wholly Foreign-Owned Enterprise (WFOE). Both allow hiring, but the processes differ greatly.

| Factors | EOR/PEO in China | WFOE Setup |

| Time to hire | Days | 3 – 6 months |

| Legal entity needed | No | Yes |

| Cost | Service fees only | High registered capital, ongoing compliance |

| Compliance risk | Handled by PEO/EOR | Company responsible |

| Scalability | Easy to scale or exit | Long-term commitment |

Therefore, for companies testing the market, PEO/EOR is a flexible first step. WFOEs are better for firms planning long-term, large-scale operations.

6. Payroll and HR Compliance Under China EOR Services

Payroll in China is more complex than in many Western countries. PEO/EOR payroll services ensure compliance with:

- Personal income tax (PIT). Progressive rates up to 45%, with monthly withholding.

- Social insurance and housing fund contributions.

- Reporting deadlines. Company must file with the local tax bureaus each month.

- Payroll cycle. Usually monthly, with strict deadlines.

Failure to comply can lead to fines or blocked work permits. Using a PEO payroll service reduces administrative burdens while guaranteeing employees are paid accurately and on time.

Payroll in China is more complex than in many Western countries.

7. How to Choose the Best PEO Services in China

Selecting the right PEO partner is essential, as your compliance, payroll accuracy, and even employee trust will depend on it. The wrong choice can lead to fines, disputes, or talent loss. Below are key factors for your evaluation:

- Licensing and compliance track record.

Not every PEO in China is licensed to operate legally. You always verify that the provider holds valid licenses for HR outsourcing, payroll services, and labor dispatch, where applicable. Also, you should ask for proof of compliance and check whether the provider has faced any disputes with local authorities. A strong track record ensures you won’t risk penalties.

- Experience with foreign SMEs and multinationals.

A PEO that has worked with both small businesses and large corporations understands different hiring needs. SMEs often require flexibility and cost efficiency, while MNCs demand scalability and strict compliance. Look for case studies or testimonials from companies similar to yours, especially in your industry.

- Transparent fees without hidden charges.

Some providers charge low upfront fees but add hidden costs for visa applications, tax filings, or sudden contract terminations. You should request a full pricing sheet that covers payroll, benefits, onboarding, and offboarding. Clear pricing builds trust and helps you budget accurately.

- Knowledge of local labor laws.

Chinese labor law is detailed and enforced differently across provinces. A good PEO should not only know the national laws but also local variations in minimum wage, social insurance rates, and housing fund contributions. Providers should also update you about regulatory changes that may affect your employees.

- Ability to handle expat visas and cross-border payroll.

If you plan to hire foreign experts in China, the PEO must manage work permits, residence permits, and renewals smoothly. Delays can interrupt operations and frustrate employees. For regional companies, the PEO should also provide cross-border payroll support, ensuring compliance when staff split time between China and ASEAN hubs under a China+1 expansion model.

- Cultural and HR expertise

Beyond compliance, a strong PEO understands workplace culture in China. This includes handling sensitive resignations, providing guidance on bonuses, and supporting employee retention strategies. Providers with bilingual HR staff can bridge communication gaps between foreign managers and local employees.

Read more related articles

8. Conclusion

Hiring employees in China is complex, but PEO/EOR services in China simplify the process. They provide a legal employer framework, manage payroll and benefits, and ensure compliance with labor laws. Compared to setting up a WFOE, PEO services are faster, cheaper, and less risky, making them ideal for SMEs and firms testing the Chinese market. However, choosing the right partner is critical. A reliable PEO not only manages compliance but also builds trust with employees, supporting long-term success.

📩 If you want to hire employees in China without setting up a local entity, VVR RH offers expert PEO and/or EOR solutions for foreign companies in China. Contact us today to explore how we can help you expand with confidence.

FAQ

-

What are the main HR challenges in China that outsourcing helps foreign companies solve?

The main HR challenges in China include compliance with labor contract law, managing payroll across different cities, handling social insurance and housing fund contributions, and navigating work permit requirements for foreign employees.

HR outsourcing for foreign companies in China addresses these issues by providing local expertise, payroll outsourcing services, contract management under mutual agreement rules, and support for work permits. This allows companies to operate smoothly while minimizing legal and operational risks.

-

How do HR outsourcing services in China support strategic HR management and long-term growth?

HR outsourcing services in China support strategic HR management, aligning with modern HR practices in China, including digital HR solutions, employee retention strategies, and ESG-focused HR policies. By outsourcing HR functions, companies gain access to market insights, salary benchmarks, and compliance monitoring, enabling them to build sustainable teams in China while adapting to workforce trends and long-term business objectives.

Related Posts